How Long Do Late Payments Stay on Your Credit Report?

October 24, 2024

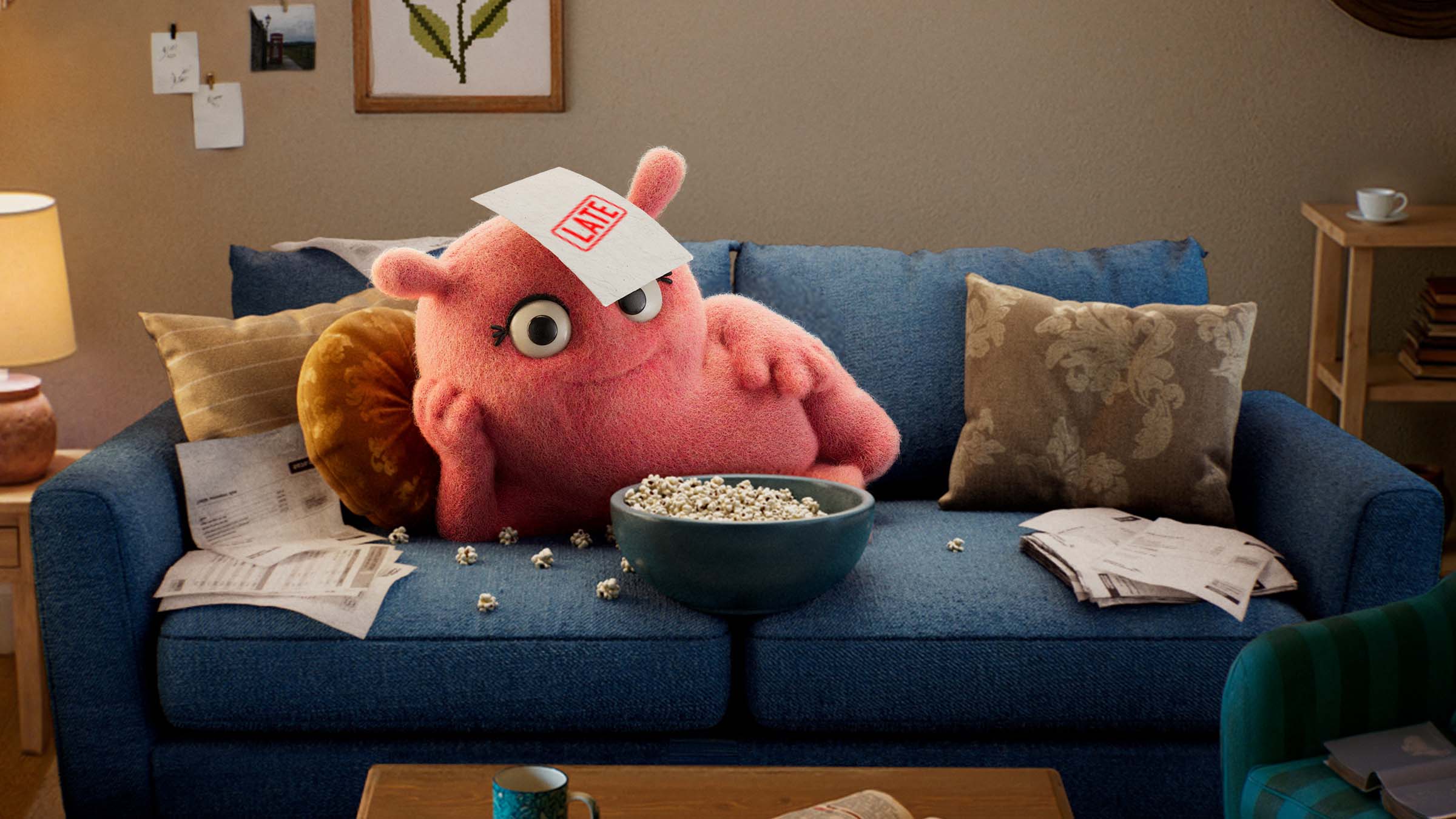

One late payment can have a surprisingly big impact, but the next steps you take can make a massive difference.

In this article:

Introduction

It happens to a lot of people — for one reason or another, you didn’t make a payment on time and now it’s past due.

Even one late credit card payment can stay on your credit report for some time. But like some of the other things that happen when you make a late credit card payment, you can minimize the impact if you take the right steps.

What’s Considered a Late Payment?

Strictly speaking, a late payment is any payment that isn’t received by your creditor by the payment due date for that billing cycle.

A payment is also considered late if you’ve made a payment before the due date, but for less than the minimum amount due.

However, credit card issuers generally won’t report a late payment to any of the major consumer credit bureaus until it is at least 30 or sometimes 60 days past due. At this point, since a payment wasn’t made within the account’s billing cycle, it’s considered a missed payment.

Many issuers will also charge a late fee. Each one has different policies and rules, so you’ll want to contact your lender to understand their reporting practices around late fees.

How Long Does a Late Payment Stay on Your Credit Report?

Once a late credit card payment is reported to the credit bureaus as a missed payment, it stays on your credit report for up to seven years from the date of the original delinquency.

Even if you make up for the amount in a later billing cycle to bring your account current, that missed payment remains a part of your payment history, unless you take further action.

How Much Does a Late Payment Affect Your Credit Score?

According to FICO, missing a credit card payment by 30 days can make your credit score drop by nearly 100 points. A longer delinquency or multiple delinquencies will negatively impact your credit score even more.

How Can You Improve Your Credit Score After a Late Payment?

If there’s already a missed payment on your credit report, you might be wondering what you can do to improve your credit score. Fortunately, you can take action if a late payment has already affected your score.

Bring your account current

Bringing your account current is an essential first step in the process of improving your credit score after a missed payment. Make the necessary payments as soon as possible.

Display good credit habits

After getting your accounts current, continue making your payments on time. A one-time occurrence tells a different story than a frequent pattern.

Older credit report items also tend to have a smaller impact on your score as time goes on, so as long as you avoid falling behind again — and continue to display good credit habits — you’ll start to bounce back.

Use AutoPay and other account features

Life can get busy. Understandably, many late payments happen because of a forgotten bill or due date.

A good way to avoid this is by setting up automatic payments. Many card issuers also allow you to change your payment due date to something that fits your needs better.

Taking advantage of these convenient options can help you prevent late or missed payments.

Is It Possible To Get a Late Payment Removed From Your Credit Report(s)?

We’ve established that creditors often report missed payments to one or more of the major credit bureaus and that those payments will typically stay on credit reports for seven years.

We’ve also mentioned how you can prevent late payments from happening again. But what can you do about the one you already have?

Luckily, there are options for getting a late payment removed from your credit reports.

With a goodwill letter, you can request that the creditor remove the late payment information they reported to the bureaus.

Take note that this is effectively a negotiation, and the lender isn’t under any obligation to remove the information if it’s accurate. But it does happen.

Share your history of making on-time payments, explain any circumstances that contributed to the lapse, but also take responsibility. And as with many things, a kind and courteous tone can only help. Here are a few more tips on writing a goodwill letter.

If you still owe your card issuer money, you can ask if they could remove the late payment as part of repayment arrangements. If your lender agrees to this, be sure to ask for your agreement in writing.

Bottom Line

A late credit card payment can have a big impact on your credit if not addressed. And while the best time to prevent that is before it happens, you can also take action to mitigate and even repair that impact.

If you want to rebuild credit with a new credit card, see if you pre-qualify for one from Credit One Bank.