Bump-Up Jumbo Certificate of Deposit

(Bump-Up CD)

Our High Yield Bump-Up CDs offer among the most competitive rates, plus the ability to earn a higher rate if our rates go up.

- Option to adjust your rate to a higher rate one time during the term of your CD1

- Enjoy peace of mind with our 10-Day Rate Guarantee2

- Our Loyalty Rate Program grants you a Loyalty Rate increase of 0.05% when you renew your CD3

Industry-leading Rates and Flexible Terms

Choose the commitment level that best fits your financial strategy

Account Benefits

No Maintenance Fee

you without monthly fees

getting in the way.

FDIC Insured

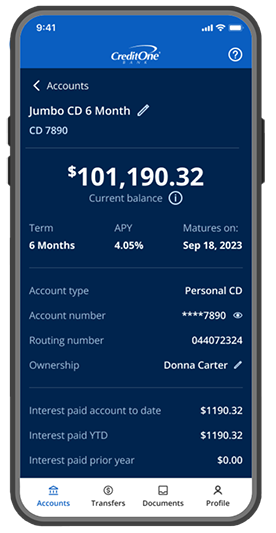

Easy Account Management

is simple with our website and

mobile app.

Ready to open an account?Get set up in just a few minutes

Select your term

Choose the level of commitment

that's right for you.

Create your online profile

We only need a few key pieces

of information.

Fund your account

Transfer from another bank account.

† Rates subject to change. Fees may reduce earnings. A penalty may be imposed for early withdrawal.

1 Beginning on the 11th calendar day after opening your CD Account, and for the remainder of the term of your Bump-Up CD Account, you may elect one time to exercise your rate bump. If you choose to exercise your rate bump, we will adjust the rate on your Bump-Up CD Account to match the current rate that we offer for the a Bump-Up CD Account of the same term. Your adjusted rate will apply from the time you exercise your rate bump until your maturity date. The adjusted rate will not be retroactive to your opening date

2 After you open a CD account with us, if we increase the interest rate and Annual Percentage Yield (APY) we offer for the same CD product and term you selected within 10 calendar days of your account opening date (account opening date plus 9 calendar days), we will automatically give you the increased rate and APY.

3 Receive a .05% Loyalty Rate increase when you renew your CD account with us. The Loyalty Rate increase is subject to change and may be discontinued at any time. When your CD is approaching maturity, visit our CD homepage to see what our current reward is at that time. Please see our FAQs for additional information.