Personal loans are useful for managing necessary expenses you may not have the ability to pay for upfront and for consolidating debt. Because of loan amortization, you can pay off your debt with a set end date (or earlier) and save money on interest.

Need to cover the costs of car repairs? Excited about purchasing a new refrigerator? Find out how a personal loan can help you meet your financial goals.

What Is A Personal Loan?

A personal loan is an unsecured or secured loan you can take out when you need extra cash for personal expenses or for debt consolidation. Like auto, student, and home loans, personal loans are usually offered with a fixed term and a fixed interest rate. You pay off the loan in installments, which is why these loans are commonly referred to as installment loans. You’ll get one lump sum of cash and then make fixed monthly payments over the course of the loan to pay it off within a predetermined time period. This is different than a credit card with a revolving line of credit with which you can keep borrowing against your credit line while not having to pay a defined set amount to principal.

Paying off a personal loan can help you build a more robust credit history. Ideally, you want a healthy mix of different types of loans on your credit file. If you have multiple credit cards, a personal loan will help to increase your ratio of installment loans.

When To Take Out A Personal Loan

You shouldn’t borrow just to give yourself extra spending money as you’ll be left with less borrowing power to deal with financial emergencies in the future. Personal loans are, however, well-suited for many of life’s necessities:

- Help with medical bills

- Improve the value of your home with new appliances, furnishings, or a home improvement project

- Finance your educational expenses such as tuition or a new computer

- Cover necessary short term expenses such as moving costs

Many people use personal loans for debt consolidation. If you are paying down multiple loans, such as several credit cards and an auto loan or student debt, you can simplify your payments with one lender and potentially lower your overall interest rate.

For those unexpected events—costly veterinary bills, car repairs, funeral expenses—a personal loan can be an attractive option for taking care of necessary costs without having to worry about increasing your credit card debt.

How Does A Personal Loan Compare To A Line Of Credit?

When you opt for a personal loan instead of a line of credit, you’ll be able to pay down the debt on a set schedule because of amortization. What is loan amortization? It is the process of paying down your balance with a specified interest rate and fixed payment period. With each installment, usually paid monthly, you’ll pay down both the interest and the principal.

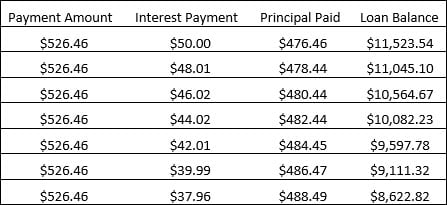

If you look at an amortization schedule, you’ll see that at the beginning of the loan term, less money goes towards reducing principal and a majority goes to interest. As the principal is paid down more and more over time, this shifts. More of each payment goes towards reducing the principal amount and less goes towards interest.

Here’s an example of a $12,000 loan with a 5% interest rate, paid over a 24-month period. Notice how the amount paid in interest decreases each month and the amount used to reduce the principal amount increases each month, but every month the installment payment amount is the same.

Paying off debt in this way can be easier because of the set schedule. By reducing the principal balance over time, you reduce the amount of interest you’ll pay. It is possible to shorten the life of a loan—and reduce your total interest paid—simply by putting a little extra towards reducing your principal each month.

When taking out a personal loan, it is important to pay attention to loan origination fees, penalties for making pre-payments, and the compounding period. The more frequently the interest is compounded, the more expensive the loan.

Keep these potential expenses in-mind when you shop around for personal loans. For example, not all lenders charge origination fees and pre-payment penalties. Additionally, building your credit history with on-time credit card payments on a Credit One Bank® Visa® can help you qualify for an installment loan to buy a car or furniture of your dreams.