February 10, 2025

The financial experiences people have early on, whether positive or negative, shape their relationships with money for life. They can affect how people handle paycheck deposits, savings accounts, bills, and credit cards well into adulthood. However, these lessons differ between generations, based on the larger economic situation and what their parents learned in their own youth. That’s why we surveyed 1,000 Americans: to get an in-depth look at the financial habits, traumas, and attitudes each generation developed during their formative years.

Key Findings

Here’s what we discovered about each generation's relationship with money:

The high cost of living is the biggest financial barrier across generations.

Only 19% of baby boomers and 17% of Gen Z feel financially worse off than their parents, compared to 35% of Gen X and 33% of millennials.

Baby boomers (65%) rarely or never discussed finances during their upbringing, whereas 30% of Gen Z frequently did.

Millennials (53%) and Gen Z (50%) discuss investing and retirement more than Gen X (36%) or baby boomers (28%), reflecting younger generations' focus on financial growth.

Lack of financial education affects all generations — including 54% of Gen Z and 67% of baby boomers — but Gen Z faces greater anxiety (59%) than boomers (29%).

Gen Z (35%) are more likely than baby boomers (12%) to discuss finances only during stress, reflecting a reactive approach to money management.

Young Americans Are Having Open Conversations About Money

Each generation has become increasingly more open about discussing money with their family.

Only 7% of baby boomers always discussed finances with their family while growing up. However, 65% rarely or never discussed money in their formative years.

13% of Gen X always talked about money as children, but a majority (51%) rarely or never did.

23% of millennials conferred with parents about money all the time, with 39% rarely or never having such talks.

30% of Gen Z always talked about money with family, while 36% said they rarely did.

Boomers and Gen X grew up in a society that valued independence and self-sufficiency. However, changing norms and the adoption of social media allowed younger generations to express themselves more openly and easily. These dynamics helped Gen Z feel comfortable communicating about difficult topics like personal finance.

This openness extends to conversations about investing, retirement planning, and long-term financial aims. This topic was also more common among younger generations:

28% of baby boomers;

36% of Gen X;

53% of millennials;

50% of Gen Z.

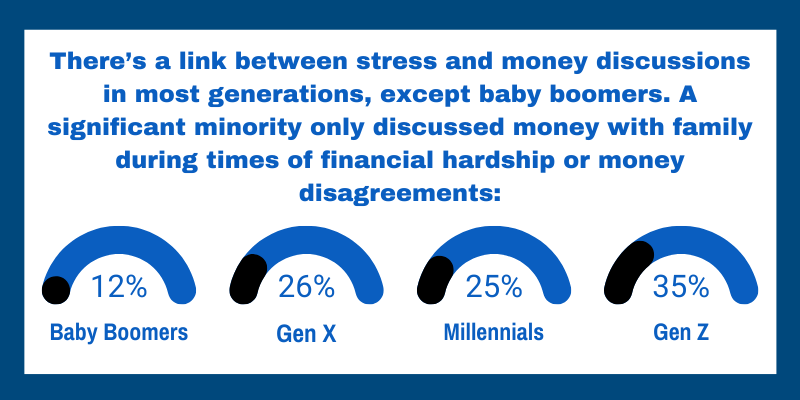

Finally, there’s a link between stress and money discussions in most generations, except baby boomers. A significant minority only discussed money with family during times of financial hardship or money disagreements:

12% of baby boomers;

26% of Gen X;

25% of millennials;

And 35% of Gen Z.

Those who grew up seeing money as more stressful could develop a more anxious attitude when it comes to money matters.

Not everyone takes on responsibility for their finances once they hit adulthood. In fact, there are significant differences between generations in this area.

73% of baby boomers began managing their own finances between age 18 and 24. Only 16% started overseeing their own accounts before 18.

59% of Gen X began managing their own bills between 18 and 24. A far higher number compared to baby boomers, 28%, started before age 18.

56% of millennials took over their accounts between 18 and 24; 23% took responsibility for their money before age 18.

Surprisingly, 15% of millennials didn’t start tracking their bills and budgets until they were between 25 and 30 years old.

72% of Gen Z started managing their finances between the ages of 18 and 24, with only 17% starting before age 18.

Most Americans started their money management responsibilities at a relatively early age, but many (38%) didn’t have any formal education until adulthood. This figure jumps to 45% for Gen Z and 50% for millennials.

Gen Z’s Parents Taught Them About Personal Finance While Baby Boomers Taught Themselves

Where did Americans learn about personal finance? Only a small number learned about personal finance from school (between 6% and 9% across all generations). A majority got their money management instruction from parents or were self-taught — but not everyone was.

47% of baby boomers were self-taught, and 39% learned from parents or guardians.

37% of Gen X studied money management on their own, with 48% learning from their parents.

31% of millennials taught themselves, and 52% learned from family members.

Only 11% of Gen Z taught themselves to manage their accounts, and 67% learned from their parents.

Baby boomers were most likely to learn by themselves. This makes sense, considering that the staggering majority of baby boomers (all but 7%) didn’t regularly discuss money matters with family members.

Does the self-taught approach bring any lasting benefits? Today, older generations need to acquire digital financial literacy. Self-taught baby boomers and Gen X can apply the same individual learning skills they honed in their youth to master new computer or app-based money tools.

Americans Believe Their Past Led To a Positive Financial Future

Growing up, some Americans regularly discussed proactive money management. Others lived in homes where financial matters were seen as a source of stress and hardship. How did these different experiences affect their attitudes about money as adults?

Overall, 3 out of 4 say their upbringing positively impacted their current financial situation. That figure was consistent across all generations, ranging from 70% to 79%.

For 26% of Americans, spending is the most important financial habit inherited from family members. 23% said the same thing about saving and budgeting.

When it comes to negative habits, there’s actually a lot of consistency between generations. Roughly one-third of each generation has a habit of living from paycheck to paycheck and a significant fear of debt.

Though less common, things like avoiding financial decisions (8%) and foregoing financial planning (5%) also affect each generation.

Is Anyone Doing Better Financially Than Their Parents?

There are some stark differences between how members of each generation view their own financial situation in relation to that of their parents.

55% of baby boomers said they were better off than their parents were at the same age. 20% said they had achieved about the same level of financial success and stability, and 19% claimed they were worse off than their parents.

Only 33% of Gen X were better off financially than their parents. 25% were about the same, and 35% were worse off monetarily.

37% of millennials said they were in a better position than their mother and father, 26% were about the same and 33% were worse off.

41% of Gen Z said they were in a better place financially. 24% were about the same, and only 17% were worse off.

Gen X and millennials are the least likely to say they’re better off, with Gen Z following closely. All of these generations have experienced financial challenges — like stagnant wages and rising student loan debt — that haven’t affected baby boomers to the same extent. This could be why baby boomers are more likely to claim they’re doing better than previous generations.

All that to say, while financial education and habits may have played a role, external factors also affected each generation’s financial success. After all, a poor economy could have a significant effect on someone’s finances regardless of how well their parents prepared them.

Majority of Gen Z Feels the Weight of Larger Financial Forces

How big of an impact did external factors, such as economic recessions, have on participants’ financial experiences growing up?

Roughly two of three baby boomers say outside factors influenced their financial upbringing.

64% of Gen X say the economy played a large role in their financial situation.

69% of millennials make the same claim.

Nearly 3 out of 4 members of Gen Z blame the economy for their financial development.

This upward trend could be due to an increasing awareness in each subsequent generation of how the overall economy affected their family’s finances. After all, 65% of Americans also believe their parents’ decisions and habits were influenced by larger financial forces.

Gen Z and Women Experience the Most Financial Stress

What sort of emotions do Americans feel about their finances? Are people typically anxious or stressed about money? Are they more positive and empowered? Here’s what we found:

29% of baby boomers said they felt anxiety or stress about their current financial situation. However, 61% primarily felt confidence or control over their money.

54% of Gen X reported stress and anxiety, with only 33% saying they were confident or in control of their financial situation.

51% of millennials admitted that they feel stressed about money, while 36% feel confident and in control.

59% of Gen Z were stressed or anxious, with only 35% reporting feeling empowered financially.

We also looked at the role of gender when it comes to emotional associations with money. 38% of male participants admitted to anxiety or stress, with 50% reporting confidence and control. On the other hand, 48% of women feel financial stress, while only 39% feel confident.

The difference in confidence could be due to the wealth gap between men and women. Households with women as the primary earners had 55 cents of wealth for every dollar in homes with male earners. Higher instances of stress in women are likely rooted in the challenge of having to work with much less than their male counterparts do.

Debt and Overdrafts Are Normal for Millennials

Certain generations are more likely to consider debt a normal part of their financial life than others:

35% of baby boomers thought debt was a normal part of their financial life based on family experiences growing up.

50% of Gen X participants felt the same.

48% of millennials thought debt was normal.

39% of Gen Z responded in the same way.

Often, debt can arise due to improper use of credit cards. Collectively, Americans had approximately $1.14 trillion in credit card balances in mid-2024. While carrying a balance can lead to interest charges that increase overall debt, some people can manage their balances without experiencing snowballing debt.

Which generations had positive credit card management practices? We looked at the top two reasons why each group used credit cards.

Baby boomers used cards to maximize points and for convenience when making purchases.

Gen X used cards to access credit when cash wasn’t available and for convenience.

Millennials used cards when they didn’t have cash available and to build their credit score.

Gen Z used cards to get points and boost their credit score.

Overdrafts are another indicator of debt and potential spending issues. We asked the different generations how often they’d overdrawn accounts in the past year.

86% of baby boomers hadn’t overdrawn and 10% had one or two overdrafts.

66% of Gen X avoided overdrafts, with 19% having one or two and 9% reporting three overdrafts.

54% of millennials didn’t overdraw, with 28% doing so once or twice and 10% three times. 6% overdrew six to 10 times.

61% of Gen Z avoided overextending their checking accounts. 26% had one or two overdrafts and 6% had three overdrafts.

Overall, younger generations are more likely to overdraw. Only 14% of baby boomers had any overdrafts, and 46% of millennials were drawing money they didn't have in their accounts.

Societal Norms Also Contribute to Financial Trauma

Society has a specific definition of financial success, which often involves steps like owning a home or having a savings account. These norms and expectations contribute to financial trauma for a whopping 57% of Americans.

However, this perception is significantly different across generations. Only 48% of baby boomers feel this way, which is in stark contrast to 72% of Gen Z. Both Gen X (60%) and millennials (64%) were more middle of the road in comparison.

It’s clear that younger generations were more heavily impacted by societal norms compared to their older peers. Technology and social media may play a role, creating ever-present reminders of expectations and unrealistic depictions of financial success.

The Biggest Barrier to Financial Stability? High Cost of Living

Attitudes about personal finance and money education vary across generations. However, all agree on the most significant barrier to financial stability today.

38% of Americans believe the high cost of living is the biggest obstacle to achieving financial stability today. This was the top answer for each generation, with percentages ranging from 37% to 41% for each group.

This comes as no surprise, given how dramatically the cost of living has risen over the last few years alone. That’s a financial pinch everyone can feel, regardless of their age.

Lack of income or job opportunities (18%) was the second most popular answer for all generations except baby boomers. 28% of boomers were more worried about economic factors like inflation. This perhaps pointed to their reliance on income from retirement accounts rather than wages.

Younger Americans Believe They Can Break the Cycle

Despite these hurdles, many younger Americans are optimistic about being able to overcome harmful attitudes or financial habits.

How confident is each generation about overcoming negative lessons and habits learned during their younger years? Here’s how each group rates themselves:

Baby boomers were the most confident, with 44% claiming a high level of confidence and 92% feeling generally positive.

Gen X was more tempered, with 23% reporting high confidence levels and 89% feeling highly or moderately confident.

28% of millennials gave themselves the highest rating, and 91% said they were reasonably optimistic.

33% of Gen Z respondents felt very confident. That number jumped to 93% when moderately confident survey-takers were included.

Baby boomers could have confidence from the experience and wealth they’ve built up over the years. Younger generations may lack the job stability and experience of their older peers, but they have access to technology and tools that assist with financial management. Also, some have a safety net in the form of baby boomer parents who help them financially. Nearly half of Gen Z get such assistance from their mother or father.

When it comes to actually breaking the cycle of poor financial habits, Americans believe in the power of various solutions. Low-interest loans were the most popular choice overall (23% of respondents), and also the favorite option for each generation.

Other answers included accessible financial education (21%), personalized financial counseling, and target savings or investing (17% each).

Americans also believe certain financial behaviors are best left in the past for the next generation to move forward:

Saving and budgeting strategies: 27%;

Investing for long-term security: 23%;

Spending habits and consumerism: 21%

Financial education and literacy: 13%.

16% of Americans don’t think anything needs to change for future generations to find financial success. One generation in particular holds this view: a staggering 27% of baby boomers. They’re about three times more likely to believe in the power of the status quo than Gen X, millennials, and Gen Z.

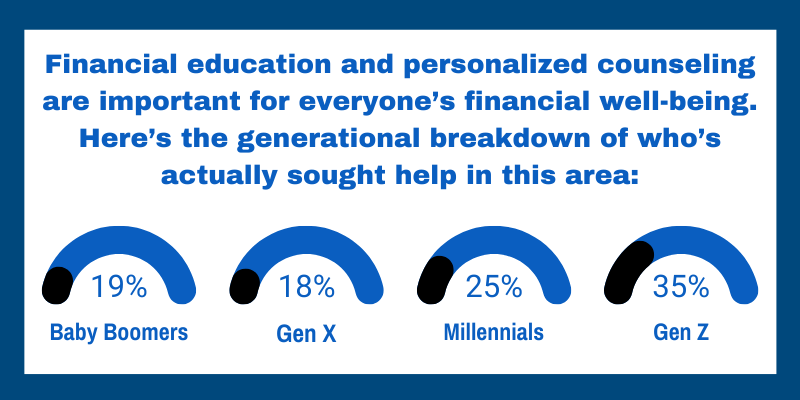

Americans Avoid Working With Financial Professionals, Despite Their Helpfulness

Financial education and personalized counseling are important for everyone’s financial well-being. Here’s the generational breakdown of who’s actually sought help in this area:

19% of baby boomers;

18% of Gen X;

25% of millennials;

35% of Gen Z.

Younger generations are more likely to seek professional financial advice. However, a majority of all generations still avoid taking this step. Worries about cost and fears of being embarrassed due to a lack of assets are factors that keep people in the realm of do-it-yourself financial management.

Younger generations may be more willing to communicate about money with family and seek professional help if they need it. People in every age group can struggle to deal with financial challenges like the high cost of living and to overcome the negative money habits and attitudes that they learned when growing up.

Methodology

For this survey, we asked 1,000 adults a series of questions about their financial history. The only qualification was that they had at least one credit card. We broke the participants down into four categories: baby boomers, Generation X, millennials, and Generation Z. This allowed us to compare the answers between generations to see how they differed.

We asked a series of questions about how the participants learned about and experienced personal finance while growing up. We also inquired about their current financial situation, attitudes, and skills to see how their past experiences affected their current financial management efforts.

Fair Use Policy

Users are welcome to utilize the insights and findings from this study for noncommercial purposes, such as academic research, educational presentations, and personal reference. When referencing or citing this article, please ensure proper attribution to maintain the integrity of the research. Direct linking to this article is permissible and encouraged to facilitate access to the original source of information. For commercial use or publication purposes — including but not limited to media outlets, websites, and promotional materials — please contact the authors for permission and licensing details. We appreciate your respect for intellectual property rights and adherence to ethical citation practices. Thank you for your interest in our research.